retirement | life | health

Simplifying Health and Wealth

Life is full of complex choices. Whether you’re looking to build wealth for retirement, transitioning to Medicare or looking to leave a legacy, we can help you do it with clarity and confidence.

Talk with an Advisormove forward with confidence

How We Help

We help American workers and retirees by taking complex decisions about their finances and their health care and simplifying them. We help you clarify your goals and understand your options, so you can move forward with confidence.

Asset Protection

Legacy Planning

Healthcare Planning

Income Protection

Working Years

Insure yourself and your loved ones against the unexpected and build your nest egg for retirement.

New Retirees

Make the right choices when it comes to Medicare, Social Security and secure your retirement income.

Retired

Manage your health care expenses, maximize your assets, minimize taxes, and leave a legacy.

Who We Help

No matter what stage of life you’re in, our holistic approach to planning and diverse solutions can help you.

Holistic Planning

Our Process

Our holistic process will help you clarify your goals, educate you on your options and implement a plan that will meet your needs now and in the future.

1. Clarify Your Goals

2. Examine Your Options

3. Implement Your Plan

Contact

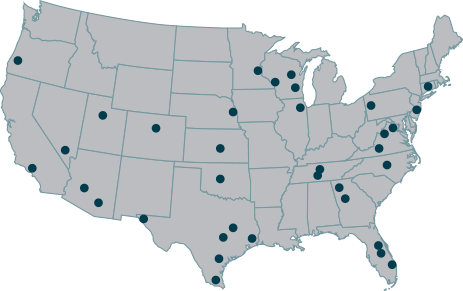

Find a Futurity First Branch Near You

Futurity First has branch offices throughout the United States, which means our advisors live, work and raise families in the same community as you. We’re here to build long-term relationships with our clients, not just sell them a product.

Service

Get the Scoop

Subscribe to Futurity Scoop, our monthly e-newsletter. Get the information you need to enjoy a happy and healthy retirement. It’s free-of-charge, and you can unsubscribe at any time.

Speak with a Licensed Advisor

You’re not alone in making these difficult health and financial decisions for you and your family. We can save you time and stress with a 360° view of your retirement. Schedule your free, no obligation consultation today.